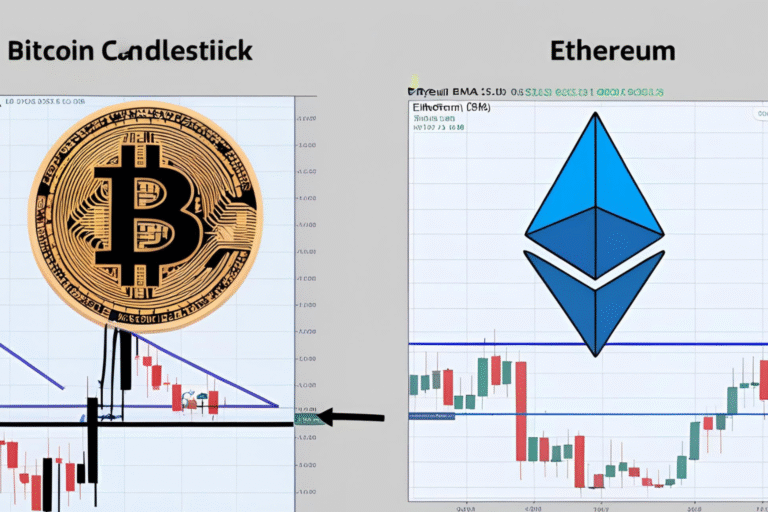

EMA Strategy for Bitcoin and Ethereum: How to Trade Crypto Trends

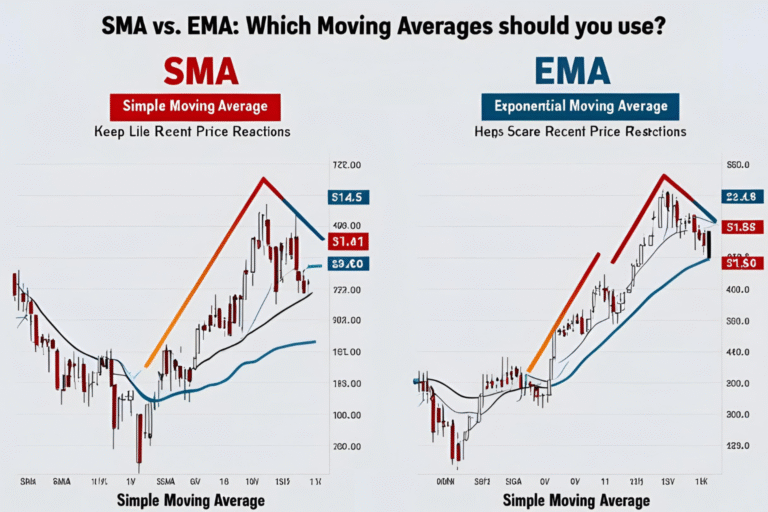

Introduction The cryptocurrency market is known for its speed and volatility, making it a perfect fit for Exponential Moving Average (EMA) strategies. Unlike simple moving averages, EMAs respond faster to price movements—helping traders catch trends early and react quickly to reversals. In this guide, we’ll break down an effective EMA strategy for Bitcoin and Ethereum,…