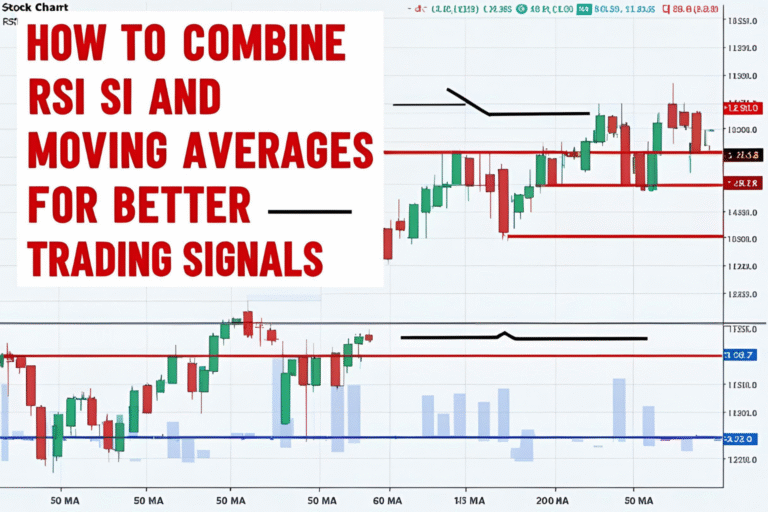

How to Combine RSI and Moving Averages for Better Trading Signals

Introduction While moving averages help identify trends, they can sometimes generate false signals in choppy markets. That’s where the Relative Strength Index (RSI) comes in. When combined, these two tools offer a powerful way to confirm setups and increase your trading accuracy. In this guide, we’ll show you how to combine RSI and moving averages…