Best Moving Average Settings for Crypto Trading (BTC, ETH & More)

Introduction

With cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) being traded 24/7 and known for high volatility, using the right moving average settings can give you a critical edge. But there’s no one-size-fits-all—different trading styles demand different timeframes and moving average types.

In this article, we’ll break down the best moving average settings for crypto trading, so you can adapt to fast markets and improve your entries and exits.

Why Moving Averages Work in Crypto

Moving averages help crypto traders:

- Smooth out erratic price action

- Identify bullish or bearish trends

- Act as dynamic support/resistance levels

- Trigger entries using crossovers or pullbacks

Since crypto doesn’t have market hours, MA setups must account for continuous price flow—especially on lower timeframes.

Recommended Moving Average Types

| Type | Use Case |

|---|---|

| EMA (Exponential) | Best for short-term trading; reacts fast to price changes |

| SMA (Simple) | Smoother, more stable; good for long-term trend analysis |

| WMA/HMA | For advanced traders; less commonly used but reduce lag further |

Most traders stick with EMA for crypto due to its responsiveness.

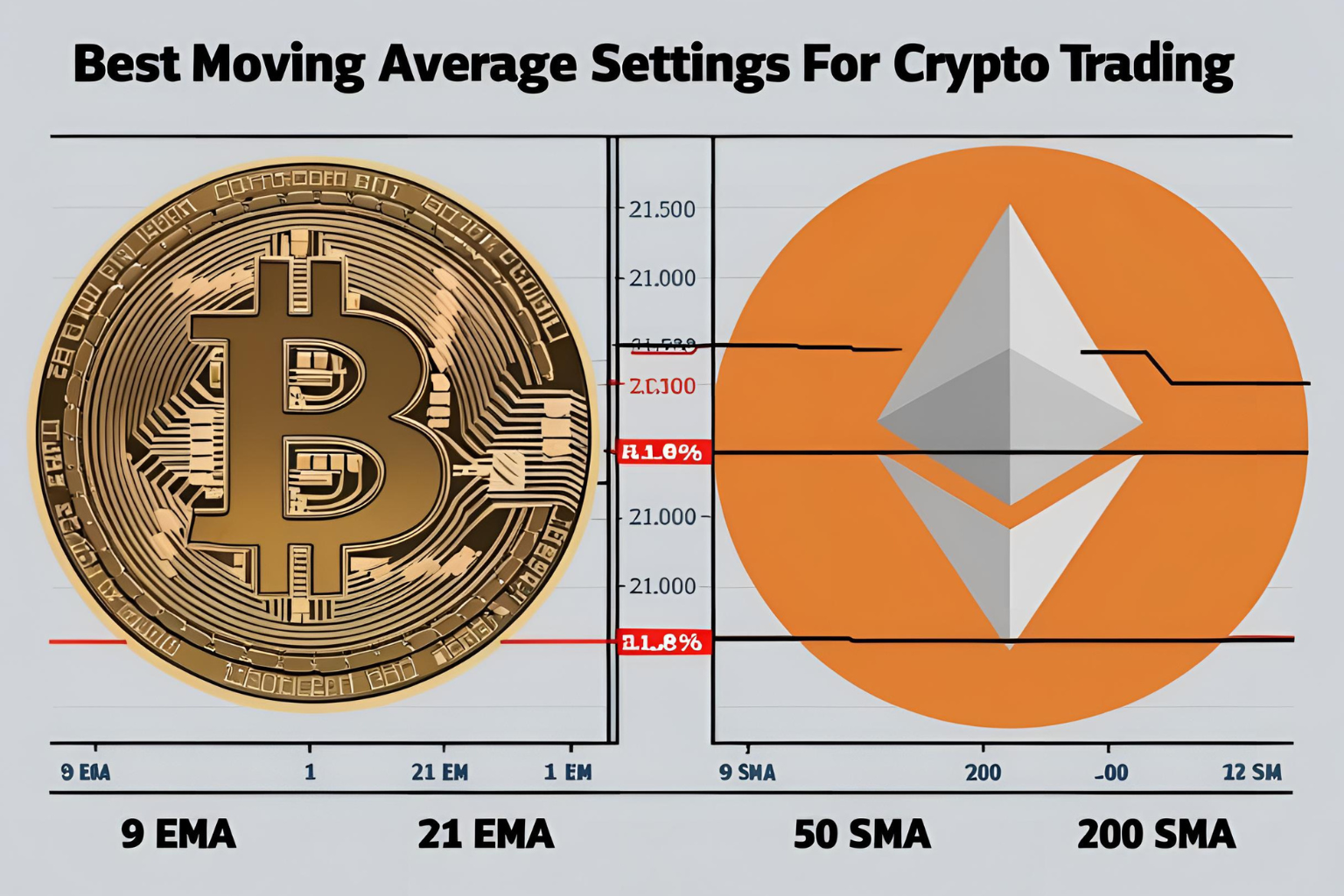

Best MA Settings by Strategy

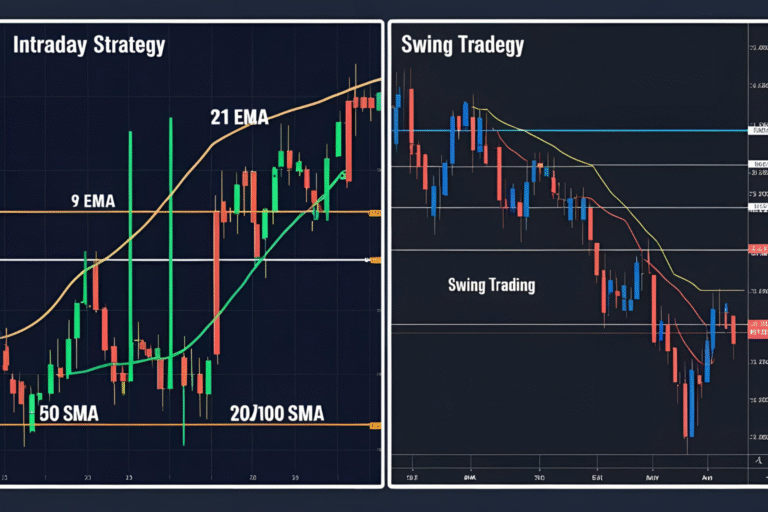

1. Short-Term Trading (Scalping/Day Trading)

- 9 EMA and 21 EMA on 5-min or 15-min charts

- Used to catch quick trend shifts and scalp momentum trades

2. Swing Trading

- 20 EMA and 50 EMA/SMA on 1-hour or 4-hour charts

- Works well for medium-duration trades over a few days

3. Trend Following / Long-Term Investing

- 100-day SMA and 200-day SMA on daily charts

- Helps you ride major uptrends and avoid staying in during downtrends

Example: BTC on a 1-Hour Chart with 20 EMA and 50 EMA

- Bullish Signal: Price holds above 20 EMA, and 20 EMA is above 50 EMA

- Pullback Entry: Look for bounce near 20 EMA with RSI confirmation

- Stop-Loss: Just below the 50 EMA or recent swing low

This setup works well during sustained uptrends or breakouts.

Crypto Trading Tips with MAs

- Use confluence: Combine moving averages with RSI, MACD, or key support zones for stronger signals.

- Avoid flat markets: MA signals fail in low-volume or sideways action.

- Stick to 24/7-aware platforms: Use TradingView or Binance charts to reflect round-the-clock crypto price flow.

Summary

Choosing the best moving average settings for crypto trading depends on your trading timeframe and style.

- Use EMAs for short-term trades,

- SMAs for long-term trend analysis,

- and always test your MA combinations in real market conditions.

Whether you trade Bitcoin, Ethereum, or altcoins, smart use of moving averages can greatly improve your technical analysis.

FAQs

What’s the most popular MA setup for Bitcoin?

9 EMA and 21 EMA on 4-hour and daily charts are commonly used.

Is EMA better than SMA for crypto?

Yes, EMA responds faster, which is essential in volatile markets.

Do moving averages work for altcoins too?

Absolutely. Apply the same principles, but be cautious of low liquidity.

What timeframes work best for swing trading crypto?

1-hour and 4-hour charts with 20 and 50 EMA/SMA are effective.

Can I use moving averages alone to trade crypto?

It’s better to combine MAs with other tools like volume, RSI, or chart patterns.