Best Moving Average Strategy for Day Trading Explained

Introduction

Day trading demands precision, speed, and a reliable strategy. Among the most trusted tools in a day trader’s arsenal is the moving average. But not all moving average setups work equally well in intraday environments.

In this guide, we’ll show you the best moving average strategy for day trading, complete with recommended timeframes, crossover combinations, and actionable trade setups.

Why Moving Averages Work for Day Trading

Moving averages are effective in day trading because they:

- Smooth out intraday price fluctuations

- Help identify short-term trends

- Act as dynamic support and resistance

- Generate trade signals when used in combination

The key is choosing the right type of moving average and the right timeframe for quick decision-making.

Recommended Moving Averages for Day Trading

The most commonly used moving averages in day trading are:

- 9 EMA (Exponential Moving Average): Very responsive to price, ideal for quick trend shifts

- 20 EMA or 20 SMA: Provides a slightly broader trend view

- 50 EMA: Useful for identifying short-term support/resistance during active sessions

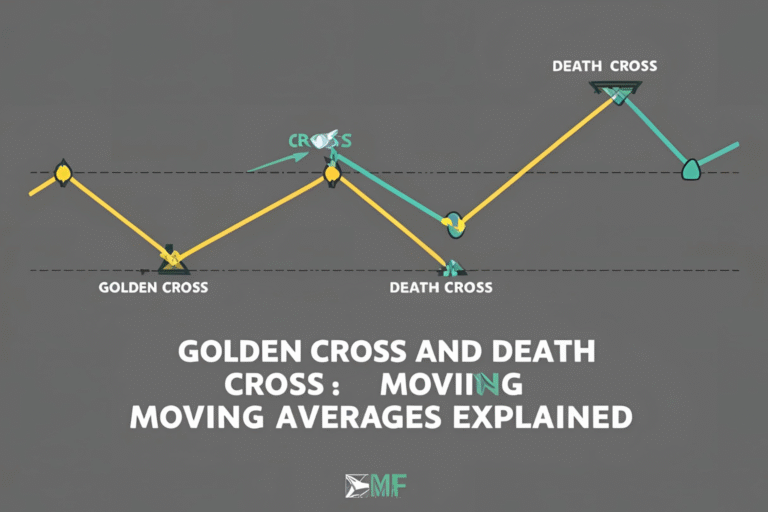

Strategy: 9 EMA and 20 EMA Crossover

One of the most effective moving average crossover strategies for day trading uses the 9 EMA and 20 EMA on a 5-minute or 15-minute chart.

Entry Signal:

- Buy Entry: When the 9 EMA crosses above the 20 EMA

- Sell Entry: When the 9 EMA crosses below the 20 EMA

Confirmation:

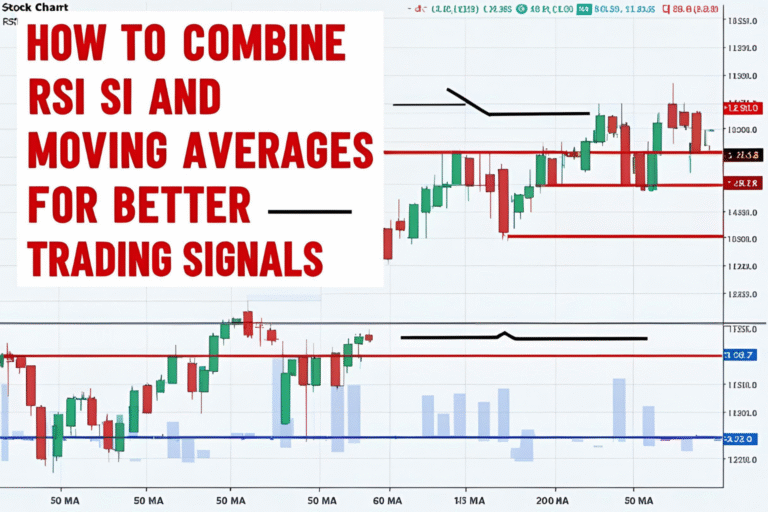

- Confirm with volume or a momentum indicator like RSI (optional)

- Avoid trading during low volatility or choppy sideways markets

Example Setup

Asset: NASDAQ stock (e.g., AAPL)

Chart: 5-minute

Indicators: 9 EMA (blue), 20 EMA (red)

Trade:

- Price is in an uptrend.

- 9 EMA crosses above 20 EMA after consolidation.

- Enter long with a stop-loss just below the 20 EMA.

- Exit when 9 EMA crosses back below 20 EMA or a set risk/reward ratio is hit.

Risk Management Tips

- Stop-Loss Placement: Just below the recent swing low (for buys) or swing high (for sells)

- Profit Target: Use a 1:2 or 1:3 risk/reward ratio

- Avoid False Signals: Don’t trade during news events or pre-market volatility

Alternative Strategy: MA Pullback Entry

Instead of waiting for a crossover, enter on a pullback to a fast MA (e.g., 9 EMA or 20 EMA):

- Price pulls back to the 9 EMA after a breakout

- Entry when a bullish candle confirms a bounce

- Works well in fast-moving intraday trends

Summary

The best moving average strategy for day trading involves combining fast-moving averages like the 9 EMA and 20 EMA for quick trend detection and precise entries. While no strategy is perfect, using MAs in conjunction with risk management and market context can help you stay ahead in volatile markets.

FAQs

Which moving average is best for 5-minute charts?

The 9 EMA and 20 EMA are commonly used for intraday trades on 5-minute charts.

Is SMA or EMA better for day trading?

EMA is preferred for day trading because it responds faster to price changes.

Can I use a single moving average instead of a crossover?

Yes. Many traders use a single fast EMA (e.g., 9 or 20 EMA) as dynamic support or resistance.

How do I avoid fake signals?

Trade only during high-volume sessions and confirm entries with additional indicators.

Do moving average strategies work for forex and crypto too?

Yes, the same strategies can be applied to forex pairs and volatile crypto assets.