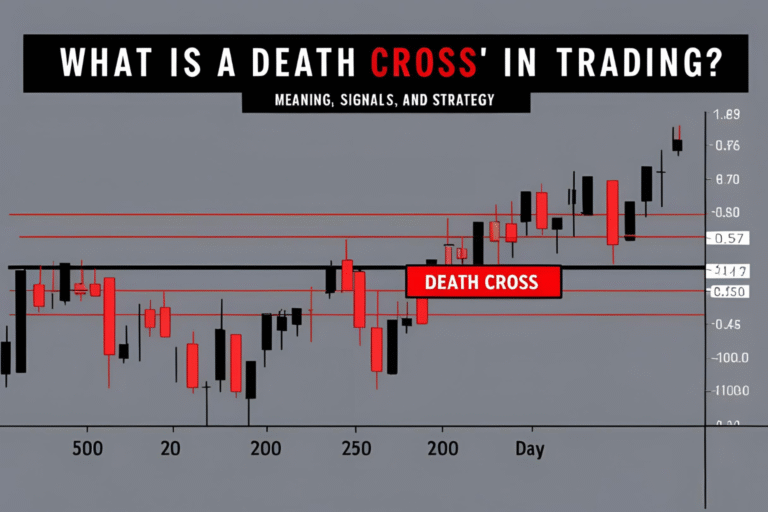

What Is a Death Cross in Trading? Meaning, Signals, and Strategy

Introduction The Death Cross is a well-known bearish technical signal that often sparks fear among traders and investors. It indicates that a market or asset may be entering a prolonged downtrend—and is closely watched across stocks, crypto, and forex markets. In this guide, we’ll explain what a Death Cross is in trading, how to identify…